Radio’s Audience Delivery Shot Up 19% In Spring PPM Survey.

- Inside Audio Marketing

- Jul 28, 2025

- 4 min read

Nielsen’s three-minute listening qualifier, implemented in all PPM markets in January, captures more audience by including previously uncounted short-duration listening. But how much more? In the Spring 2025 PPM survey (April-May-June), average quarter hour (AQH) listening among adults 25-54 soared 19% when compared to Fall 2024, before the new qualifier was adopted.

In fact, there are significant listening increases captured in the Spring PPM survey across all demographics and dayparts, vs. Fall 2024.

For a macro view of the impact of Nielsen’s three-minute qualifier, Westwood One VP of Researcher Scott Anekstein conducted an analysis of the Spring 2025 PPM data, which aggregated all average quarter-hour audiences from 47 markets. He then compared that fresh data with Fall 2024 (October-November-December) PPM audience estimates, which were calculated when Nielsen was using the old five-minute listening qualifier.

Reinforcing the notion that a rising tide lifts all boats, the comparison shows double-digit adults 25-54 AQH growth in all dayparts. The time period with the biggest boost is nights, where the inclusion of short listening occasions lifted reported AQH by a whopping 31%. Weekends shot up 24%. The total week lift was 19.4%.

Similarly, the higher reported audiences are consistently strong across all demographics, up anywhere from +17% to +19%.

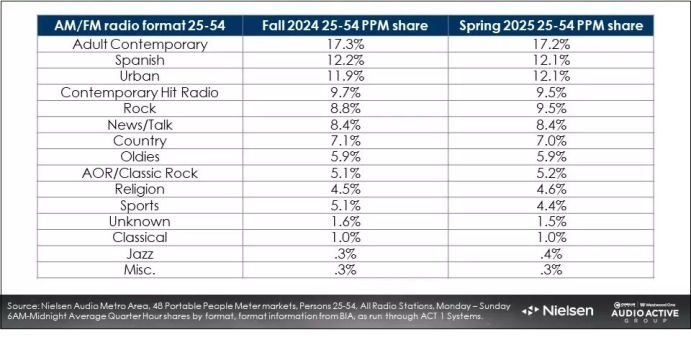

While programmers are always on the lookout for how any significant ratings methodology change might impact individual formats, the Spring 2025 numbers show format shares are remarkably stable. Adult contemporary still wins the 25-54 battle with a 17.2 share in Spring 2025 compared to 17.3 in Fall 2024. Spanish, Urban, CHR and Rock round out the top five, their positions unchanged from Fall 2024.

It’s important to note that the new numbers don’t mean more listening is taking place. Instead, more existing tune-in is being captured by Nielsen, thanks to lowering the threshold of what constitutes a listening occasion from five minutes within a quarter hour to three, as of the January 2025 PPM survey. The new methodology wasn’t implemented in diary markets, where listening is self-reported by diarykeepers.

What About Radio’s Entire Audience?

Network radio advertisers transact on Nielsen’s national audience service known as Nielsen Nationwide. It rolls up all listening from PPM and diary markets together. The first Nationwide survey to reflect the impact of the modernized PPM data will be the Spring 2025 survey, which won’t be released until September.

In the meantime, to gauge how the three-minute qualifier impacts radio’s entire national audience, Anekstein conducted a national AQH analysis using the latest Spring 2025 PPM markets and all the diary markets from the Fall 2024 survey. Anekstein combined Nielsen’s PPM AQH audiences from Spring 2025 (with the new three-minute edit rule) with diary audiences from the Fall 2024 Nationwide survey. The comparison revealed total U.S. 25-54 listening grew 7%. The smaller increase makes sense since PPM markets account for about a third of total U.S. AQH (35% P12+) while diary markets make up the rest.

Pierre Bouvard, Chief Insights Officer of the Cumulus Media/Westwood One Audio Active Group, says the growth in PPM audiences will cause top market indices to increase for all U.S. network radio audiences. In a blog post, he says the new modernized PPM methodology will cause the trend of AM/FM radio surpassing TV in ratings to accelerate. “Over the last five years, AM/FM radio has overtaken linear TV in ratings,” Bouvard says. “Based on TV and AM/FM radio audience forecasts, 2026 will see AM/FM radio likely overtake linear TV in the all-important 25-54 demographic and widen its ratings lead over TV among 18-49s.”

Moreover, when advertisers conduct post-buy analyses this year, they will find they overachieve their 2024 media plans. “In PPM markets, expect increases in audience deliveries based on prior year schedules,” Bouvard says. That reinforces research conducted by Nielsen VP, Cross Platform Insights Tony Hereau presented during a May 1 RAB webinar. After pulling 300+ ad schedules that ran on commercial stations in every PPM market in Q4 2024 and extrapolating their impact on adults 25-54 in Q1, when the three-minute qualifier was in place, Hereau’s analysis showed a 20% across-the-board increase in Gross Rating Points.

Time To Toss The Bowtie?

Bouvard also predicts radio’s reach will increase this year, due to all the additional listening occasions being included in PPM measurement. And he encourages stations to rethink how they distribute commercial loads across the broadcast hour, particularly in PPM markets where “bowtie” placements (two long spotsets per hour that straddle the :15 and :45 positions on the clock) have become the norm. “With a three-minute quarter hour qualification, stations can create more breaks of shorter duration, which will significantly benefit advertisers,” Bouvard contends. “AM/FM radio ads will become more effective as stations increase the number of commercial breaks with shorter durations.”

To back up his argument, Bouvard points to a 2011 PPM study of 17,896,325 unique commercial breaks involving 61,902,473 minutes of advertising conducted by Nielsen, Media Monitors, and Coleman Insights that found that the shorter the ad break, the greater the audience retention. It showed two-minute ad breaks retain 99% of the lead-in audience, while six-minute ad breaks retain 85% of the lead in audience, a difference of 14 percentage points.

“Creating more ad breaks of shorter duration generates larger commercial audiences. Advertisers stand out more in shorter breaks,” Bouvard continues. “Growing audience deliveries for AM/FM radio ads improve AM/FM radio’s performance in media mix modeling and marketing effectiveness studies.”

Comments