Podcast Ad Spending Up 26% In Q3 As Ad Loads Hit Five-Quarter High.

- Inside Audio Marketing

- Nov 5, 2025

- 3 min read

Podcast advertising continued its strong run into the second half of 2025, with total spending rising 26% year-over-year in the third quarter, according to Magellan AI’s Q3 Podcast Advertising Benchmark Report. The firm didn’t release total spending estimates, but it does say that after a modest start for the quarter in July and August, when spending actually trailed 2024 results, Magellan says spending accelerated sharply in September. That pushed total Q3 outlays 3% higher than Q2.

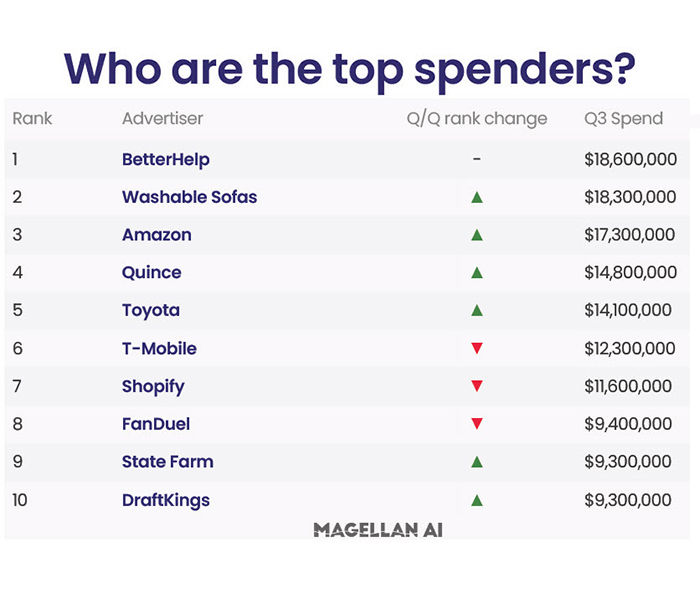

The top ten advertisers collectively invested an estimated $135 million — up 6% from what the top ten spent during Q2 — with nine repeat spenders from the previous quarter. BetterHelp remained No. 1 at $18.6 million, followed closely by Washable Sofas, a newcomer to the list at $18.3 million, and Amazon at $17.3 million. Rounding out the top tier were Quince, Toyota, T-Mobile, Shopify, FanDuel, State Farm, and DraftKings.

The Gaming sector was the fastest-growing ad category during third quarter with its overall investment in podcasting up 59% quarter-to-quarter, led by campaigns for Tony Hawk’s Pro Skater 3 + 4, Alienware, and NBA 2K26. Other fast-rising categories included Dating and Transportation, both up 41% quarter-to-quarter, and Food, which was up 23%.

Magellan says Financial Services continued to lead overall spending at $89.6 million, up 8% from a year earlier, followed by Consumer Services and Software, which totaled $75 million — up 58% year-to-year. Business Services and Software spending totaled $69.7 million, up 36%. Notably, Women’s Clothing brands increased podcast spend 117% year-over-year — the largest jump of any major sector.

Podcasting’s brand diversity continues to grow, along with the dollars. In a progress report on that effort, Magellan says 1,689 brands advertised on podcasts for the first time — a 41% increase from Q2 — signaling that momentum continues to build among new entrants. The average test budget was $33,900 for brands new to podcasting, which was 20% less than what newcomers spent in Q2.

Sports podcasts remained the most common entry point for new advertisers. “Sports continued to be the most popular genre for new brands to run on in Q3,” Magellan says in its quarterly benchmark report. It says one out of every five new brands included sports podcasts in their media plan. It was followed by Comedy and News, each attracting about 10% of first-time brands.

Magellan also says produced spots saw the fastest growth, with ad spending up 67% year-over-year, while host-read ads climbed 32%, and programmatic/run-of-network buys remained roughly flat.

Brand awareness campaigns overtook direct-response efforts in share of total spending, accounting for 56% of market spending, vs. 41% for direct response and 3% for tune-in promotions. Average monthly spending rose 6% for brand campaigns and 50% for tune-in, while direct-response outlays slipped 2%.

In response to the growing ad demand, podcast ad loads crept upward in Q3, averaging 8.34% of total episode content, up from 8.11% in Q2, according to Magellan. The share was nearly flat year-to-year but reflected a 2.3% gain in advertiser ad load, suggesting continued monetization pressure across premium shows.

Twelve of the 13 major genres increased ad density, led by Society & Culture, which jumped to 10.68%, while Kids & Family dipped to 8.18%. Shows between 30 and 60 minutes — the most common length — averaged roughly 9% ad load, with shorter segments under 15 minutes running far heavier, sometimes reaching 40% of total content.

But the biggest picture shows one of a maturing business. Ad loads have now held near the 8% mark for five consecutive quarters, also signaling a steady ad market, according to Magellan’s analysis.

Among the other findings in Magellan’s quarterly update is the continued concentration of ad dollars. It reports that in Q3, advertisers spent an average of $355,000 per month on top 500 shows. That’s up 12% from the prior quarter. That compared to $40,000 spent on podcasts ranking 501 to 3,000 — a $1,000 increase from Q2.

The report says more than a third (36%) of ads run during Q3 were 30 seconds, making that length the most popular pick among advertisers. Another 14% of ads were 15 seconds, while 17% were a minute in length.

Direct response made up 41% of overall market spending during Q3, a slight increase from Q2, with brand awareness at 56%, and tune-in at 3%.

Download a copy of Magellan AI’s Quarterly Podcast Advertising Benchmark Report HERE.

Comments