New Study Shows AM/FM Radio Outperforms Advertiser Perceptions.

- Inside Audio Marketing

- Sep 3, 2025

- 2 min read

Marketers have long believed that newer media are always more effective advertising vehicles compared to whatever came before, yet research shows this isn't the case, especially when it comes to AM/FM radio.

“Ad industry perceptions of media audiences are often completely opposite reality,” Cumulus Media/Westwood One Audio Active Group Chief Insights Officer Pierre Bouvard says in an analysis of several studies in Westwood One's blog, which debunks many agency and marketer myths about radio.

One set of brand misperceptions involves the weekly strength of AM/FM radio. The more-than-300 media agencies and advertisers surveyed by Advertiser Perceptions in August 2025 said 40% of Americans are reached by AM/FM in an average week, less the half of the actual 87%, according to Nielsen.

While many brands believe the 18-34 demographic doesn't listen to AM/FM radio, nothing could be further from the truth. Nielsen shows AM/FM reaches 59.4 million listeners in the demo weekly, higher than 35-49 (55.8 million), 50-64 (56.0 million), or 65+ (54.8 million).

Although Advertiser Perceptions' sample said AM/FM radio's audience share is 26%, vs. ad-supported Spotify's 25% and ad-supported Pandora's 16%, neither of the two digital music platforms comes close to AM/FM. Based on Edison Research's “Share of Ear,” AM/FM radio dominates with a 68% share, vs. 5% for both Spotify and Pandora. AM/FM is even stronger in cars, at 85% vs. 2% for either Spotify or Pandora.

While advertisers may support media plans focused on just connected TV, digital, and linear TV, Nielsen Media Impact shows that adding AM/FM radio significantly boosts total reach, from 66% to 78%. “AM/FM radio always elevates the media plan,” Bouvard says. “Shifting just 10% of the connected TV, digital, and linear TV media plan to AM/FM radio generates an impressive 18% increase in reach for the same investment.”

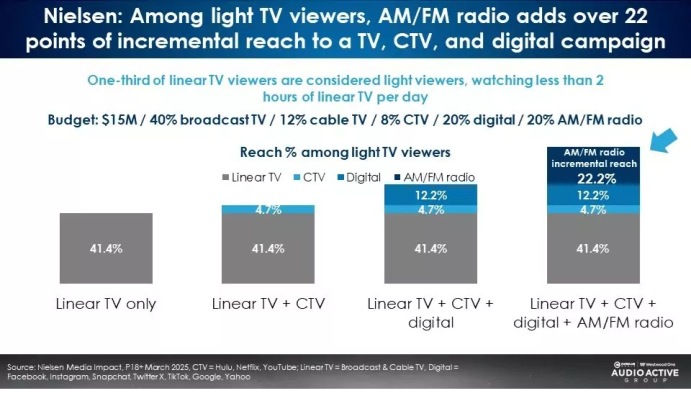

Likewise, adding AM/FM radio to a media plan generates the largest incremental reach lift from the base TV buy, according to Nielsen, up 22% vs. digital's 12% and CTV's 5%.

What about digital-only audio buys? Edison shows that the combined ad-supported daily reach of Spotify, podcasts, and Pandora is just 30%, missing 70% of America, while AM/FM radio has a daily reach of 61%.

“The reality is when you put AM/FM radio into a digital audio plan, reach soars,” Bouvard says. “The addition of AM/FM radio causes a massive lift in daily reach.”

Even when Nielsen surveyed CMOs earlier this year to get their read on media ROI, AM/FM got no respect, coming in last. Yet, as Bouvard notes, “The reality is a stark difference: AM/FM radio generates $2.14 in ROI for every dollar spent, placing it number 4.

Tossing aside another advertiser belief, the blog points out that via brand lift and sales effect studies, audio creative testing, retail location and site-and-search attribution, incremental reach analysis, and other available research, anything that can measured in TV and digital can be measured in audio.

Comments