Since COVID Outbreak, News/Talk Has Grown AQH Share By 24%.

- Inside Audio Marketing

- May 12, 2020

- 3 min read

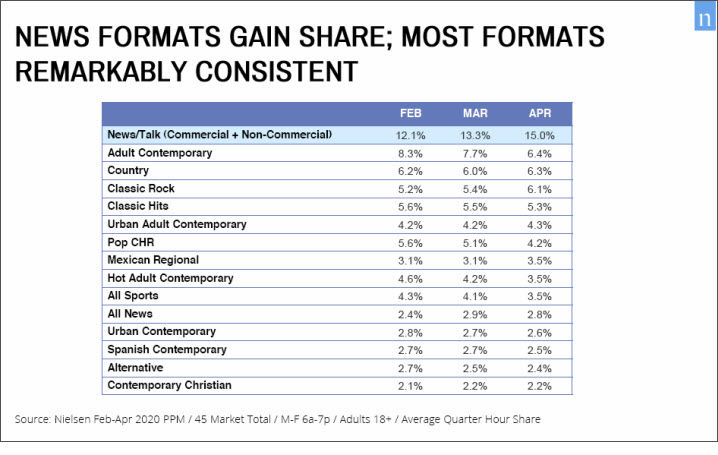

For a second consecutive month, the news/talk format registered a substantial gain in audience share as Americans continued to tune in for the latest news on the COVID-19 pandemic. The format surged to a 15.0 share in Nielsen’s April PPM survey, up from a 13.3 in March and a 12.1 in February. In the span of two months, the share of listening for news/talk has jumped 24%. That gave it a more than two-to-one lead over second place AC, which tumbled for a second straight month, from 8.3 in the pre-COVID February survey to 7.7 in March and now a 6.4 in April.

Nielsen’s April survey covered March 26 - April 22. All figures quoted are total week 6+ AQH shares. The AC format, which relies heavily on at-work listening, has been walloped by fewer Americans listening in office and other traditional work environments due to stay-at-home orders. Radio’s most-listened-to music format has experienced a 23% drop in audience share within two months. That’s allowed country to come within a tenth of a share striking distance of AC.

Country is among the formats that held their ratings ground throughout the pandemic, trending 6.2-6.0-6.3 (Feb.-March-April) for a consistent third place finish.

Classic rock, meanwhile, is the music format with the biggest gains in the two surveys impacted by changing listening behaviors as a result of the coronavirus. After inching ahead 5.2-5.4 in March, classic rock cranked it up to 6.1 in April to rank fourth. That’s up from fifth place in March and sixth in February.

One theory behind classic rock’s ratings strides are that listeners are seeking out familiar music as comfort food during the pandemic. Another notion is that there is less “forced” at-work listening to AC, now that the workplace for many is their home. “The choice of an at-work radio station is often made by one person, or which format is ‘appropriate’ (for the workplace) and the format of choice in most workplaces is AC, or Classic Hits (for the most part),” writes AC consultant Gary Berkowitz on his blog. “But now, things are different. If you’re working from home, YOU get to choose the station. Women have always had a lean towards rock music. Now that they have a choice, these rock and classic rock stations, in many markets, are climbing up the rankers and doing great.”

The format most negatively impacted by the health crisis and its radical impact on consumer lifestyles is pop CHR, which has seen its lowest shares in decades at some of its biggest stations. Within two months, pop CHR has lost one-fourth of its national audience share in PPM markets, declining 5.6-5.1-4.2. Tied for fourth in February, it ranked seventh in April. Pop CHR was already in the midst of a prolonged downturn before the coronavirus changed media behavior. The epidemic hasn’t been kind to hot AC either, which took a sharp descent in April after starting to slide in March.

The decline for these contemporary pop formats goes hand in hand with a decrease in pop music streaming, according to Nielsen Music/MRC Data, as Americans stream older songs instead of the latest pop releases.

Hampered by a full month with almost no live sports, the sports talk format took a bigger tumble in April after a minor dip in March (4.3-4.1-3.5).

Regional Mexican, on the other hand saw a decent increase since the outbreak, tracking 3.1-3.1-3.5 to tie for eighth place, up from tenth in February.

While there are winners and losers in the latest numbers, many music formats showed remarkably consistent share performances, including country, classic hits, urban AC, Spanish contemporary, alternative and contemporary Christian.

The gains and losses posted in April will likely be looked back on as an aberration since they reflect a major disruption in how Americans consume radio. Nielsen acknowledges as much in an advisory that accompanies its ratings products for the March and April survey periods.

“Audience estimates covering the time of the COVID-19 Public Health Emergency can and should be used to understand the nature of that audience during that period only since it may reflect behavior that is unique to the COVID-19 crisis,” Nielsen says. “Given the anomalous nature of audience behavior during the COVID-19 Public Health Emergency, it is Nielsen's position that future buying and planning decisions for periods that fall outside the COVID-19 crisis should not be made using COVID-19 impacted audience estimates.” – Paul Heine

Comments