Magellan AI: Podcast Ads Trend Shorter In Q2 As Ad Revenue Rose 11%.

- Inside Audio Marketing

- Aug 22, 2022

- 3 min read

Podcast ad loads may be bigger than they once were, but the commercials are trending shorter. Those are two of the takeaways in Magellan AI’s quarterly analysis of podcast advertising during the second quarter. For the first time, more a third (35%) of the ads detected were 30 seconds in length, which it says is a reflection of an increase in produced ads. One-minute ads made up another 18% followed by 15-second spots, which accounted for 11% of ads. The longer-running live read ads accounted for roughly one in ten ads.

Against that backdrop, Magellan AI says the average ad load ticked up from 5.76% of an episode’s time in Q1 to 5.99% in Q2. The Fiction genre was no longer the most ad-heavy, however. Thanks to a 0.53% drop, the analysis shows it ranked No. 4. Topping the list of genres that dedicated the largest percent of their time to advertising was Kids & Family, in which nine percent of an episode was typically ads. It was followed by True Crime and Society & Culture. Magellan AI says the Technology genre had one of the bigger increases, with six percent of episode time during Q2 going toward ads. That was a 1.13% increase from the first quarter.

Even so, for 12% of episodes, all spots typically available were filled by one advertiser according to the analysis. Magellan AI says the top genres for single advertiser episodes include Religion & Spirituality (38%), Education (19%), and Science (17%).

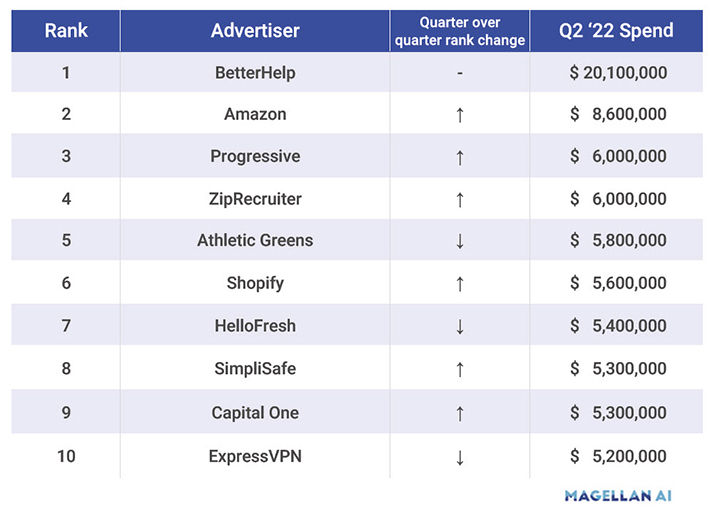

During the second quarter, Magellan AI says more than 2,070 new brands or products were advertised on podcasts for the first time, spending on average about $14,000. That included 153 new business services and software brands and 122 new financial services brands. But there was plenty of familiarity at the top. Seven of the top ten spenders during second quarter were also on the Q1 top spenders list.

The online mental health care provider BetterHelp remained the top marketer, spending $20.1 million during the first quarter on podcast advertising, according to Magellan AI estimates. That was more than double the second largest advertiser, Amazon, which spent an estimated $8.6 million. In sixth place, Shopify is the only advertiser that has not appeared on the list previously.

Overall, the top ten advertisers spent an estimated $72 million. That is up 13% compared to what the top ten spent during the first quarter. Industrywide, the total podcast ad spend estimate rose 11% quarter-to-quarter.

“Average monthly spend increased at a faster pace (+17% Q/Q) for brand awareness than it did for direct response (+6% Q/Q),” the report says. “In Q2, direct response made up 51% of the market, while brand awareness made up 46% of the market.”

Several of the quarter’s fastest-growing categories reflect an America that looks a lot more normal and on the go this summer. Live entertainment had the biggest bump, growing 126% between first and second quarters, according to Magellan AI estimates. There were also big gains in categories including pharmaceutical (+57%), travel (+45%), alcohol (+40%), and books (+39%) while two of the first quarter’s big gainers – fitness and web hosting services – had pullbacks during Q2.

The analysis also shows just how widely spread-out podcast dollars are – or are not. Magellan AI says the top 500 podcasts pocketed nearly half (47%) of the total podcast ad spend during the second quarter. That’s on par with first quarter. It says advertisers spent an average of $197,000 per month on podcasts that ranked in the top 500 compared to an average of $30,000 on shows that ranked between 501 and 3,000.

Magellan’s quarterly update is based on data it collated from more than 10,000 brands that placed ads across 76,000 episodes during the second quarter. Magellan’s proprietary model is used to estimate advertising spend. It includes factors such as the number of ads and variation in ad load detected for a given episode, number of downloads for each episode, and estimated CPMs as reported on select media kits and estimated based on popularity.

Download a copy of Magellan AI’s Quarterly Podcast Advertising Benchmark Report HERE.

Comments