DoubleVerify: Podcast Advertising Outpaces Campaign Benchmarks.

- Inside Audio Marketing

- Jul 24, 2025

- 3 min read

Podcast advertising revenue continues to climb, and a new survey is pointing to one reason that media buyers are embracing the format. A new survey by DoubleVerify (DV) finds that among North American marketers, 58% say podcast ads outperform their campaign baselines. That may trail the perceived outperformance of social media, CTV and commerce media networks, but podcasting’s performance is nevertheless beating expectations — and that could only have positive effects as media plans are drafted.

The findings are based on a survey conducted among 400 marketers in the U.S. and Canada in March. Commissioned by DV through Sapio Research, the results offer insights into buying trends in the region. The data shows social media is the advertising channel most commonly used in North America, with only 3% of marketers saying they have no interest in it. Commerce media network and connected TV are a close second and third.

Among audio options, DV finds that radio is the most-used ad channel for most brands. Its survey finds 43% of brands have AM/FM radio already part of their 2025 media plan. And another 35% say they have not yet bought radio this year — but they plan to. Less than a quarter (23%) had no interest in spending on radio, according to the survey.

Buying media buying habits, DV’s report also examines consumer behavior based on input from 3,000 people in the U.S. and Canada. “Online content consumption is on the rise in North America, with an average of 3.8 hours of leisure time spent per day consuming online content, surpassing the global average,” it says. U.S. residents consume slightly more online content than Canadians — by a 3.9 hours to 3.7 hours difference.

DV credits social media for driving the prevalence of online consumption. It says nine in ten consumers are currently engaging with social media content, and 23% say they expect to spend even more time on social media during the next 12 months.

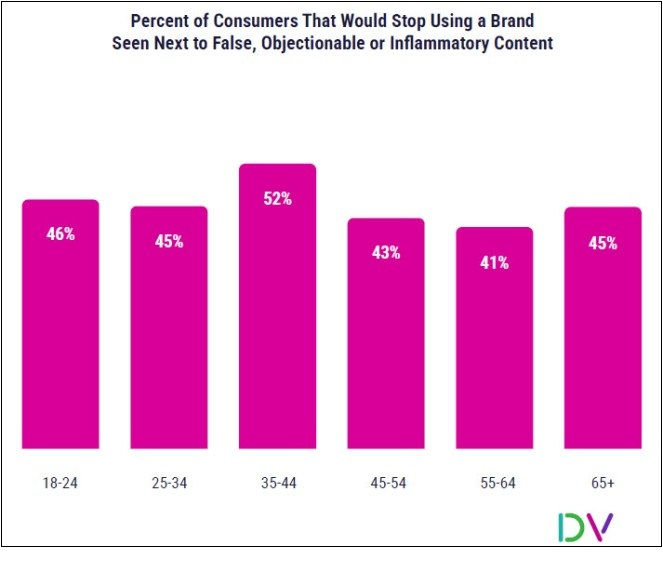

The survey also gives content publishers fresh reasons to embrace brand safety tools. Not for the ad buyer’s sake, but for the consumer’s. In North America, DV says 45% of consumers said they were likely to stop using a brand or product if an ad is displayed alongside false, objectionable or inflammatory content. And 43% of consumers said they would advise their family and friends to stop using that product as well. The data shows the backlash to objectionable content is even more pronounced in urban areas, where nearly half of consumers are likely to discontinue use. And it says men were also more likely than women to respond to objectionable content, as are consumers under age 45.

DV’s report suggests marketers have responded. In North America, the brand suitability violation rate decreased by 15% year-over-year, now standing at 4.6%, which is the lowest among all regions worldwide. DV says that highlights North America’s “strong performance” in maintaining brand suitability. “It also shows the maturity of brand suitability in the region, evidenced by high adoption of both pre- and post-bid services,” the report says.

But there is a big difference between countries. DV reports a violation rate of 4.4% in the U.S., down 17% from a year ago, compared to 9% in Canada, down 3% year-to-year. Even better news is that audio isn’t the problem. DV says a “significant portion” of brand suitability violations were attributed to display media, and specifically, mobile web display ads.

The report also shows that 41% of consumers in North America use ad blockers. DV says that underscores an urgent need for relevant, high-quality ad experiences. “Advertisers must prioritize media quality to ensure their messages are seen and trusted, even as consumer control over ad experiences increases,” its report says.

Download DV’s 2025 Global Insights: Regional Reports HERE.

Comments